Industry solutions

The Financial Action Task Force (FATF), the global money laundering and terrorist financing watchdog which sets standards and guidelines to secure the global financial industry against illegal activity, publishes lists of countries which they have identified as ‘High Risk’ and those requiring ‘Increased Monitoring’ due to a lack of anti-money laundering measures, counter terrorism financing or other regulatory standards.

Countries on the High Risk list (also known as the ‘black list’) find themselves there due to the fact that they have severe deficiencies in implementing or showing the required regulatory standards. As a result of this, the FATF advises that Enhanced Due Diligence be applied for these countries, or even counter-measures be applied against the risks that operating with entities in these countries represents.

The list of High Risk jurisdictions can be found here. At time of writing it consists of:

- Democratic People's Republic of Korea (DPRK)

- Iran

Countries on the list for Increased Monitoring (also known as the ‘grey list’) are designated as such because, although they require improvements to how they implement regulatory standards, they are actively working with the FATF to address their issues. Each country on the grey list has a timeframe to achieve the changes they are working towards (and failure to achieve results in this may result in a country moving to the black list). Despite the shortcomings, the FATF doesn’t necessitate that Enhanced Due Diligence be applied for these countries, but states that the increased risk their status shows should be taken into account.

The list of jurisdictions under Increased Monitoring can be found here. At time of writing it consists of:

- Albania

- Barbados

- Burkina Faso

- Cambodia

- Cayman Islands

- Gibraltar

- Haiti

- Jamaica

- Jordan

- Mali

- Morocco

- Myanmar

- Nicaragua

- Pakistan

- Panama

- Philippines

- Senegal

- South Sudan

- Syria

- Türkiye

- Uganda

- United Arab Emirates

- Yemen

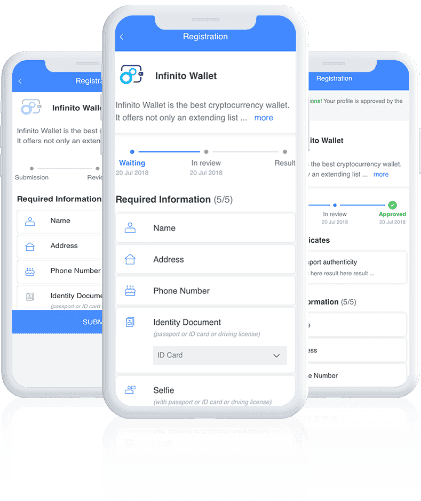

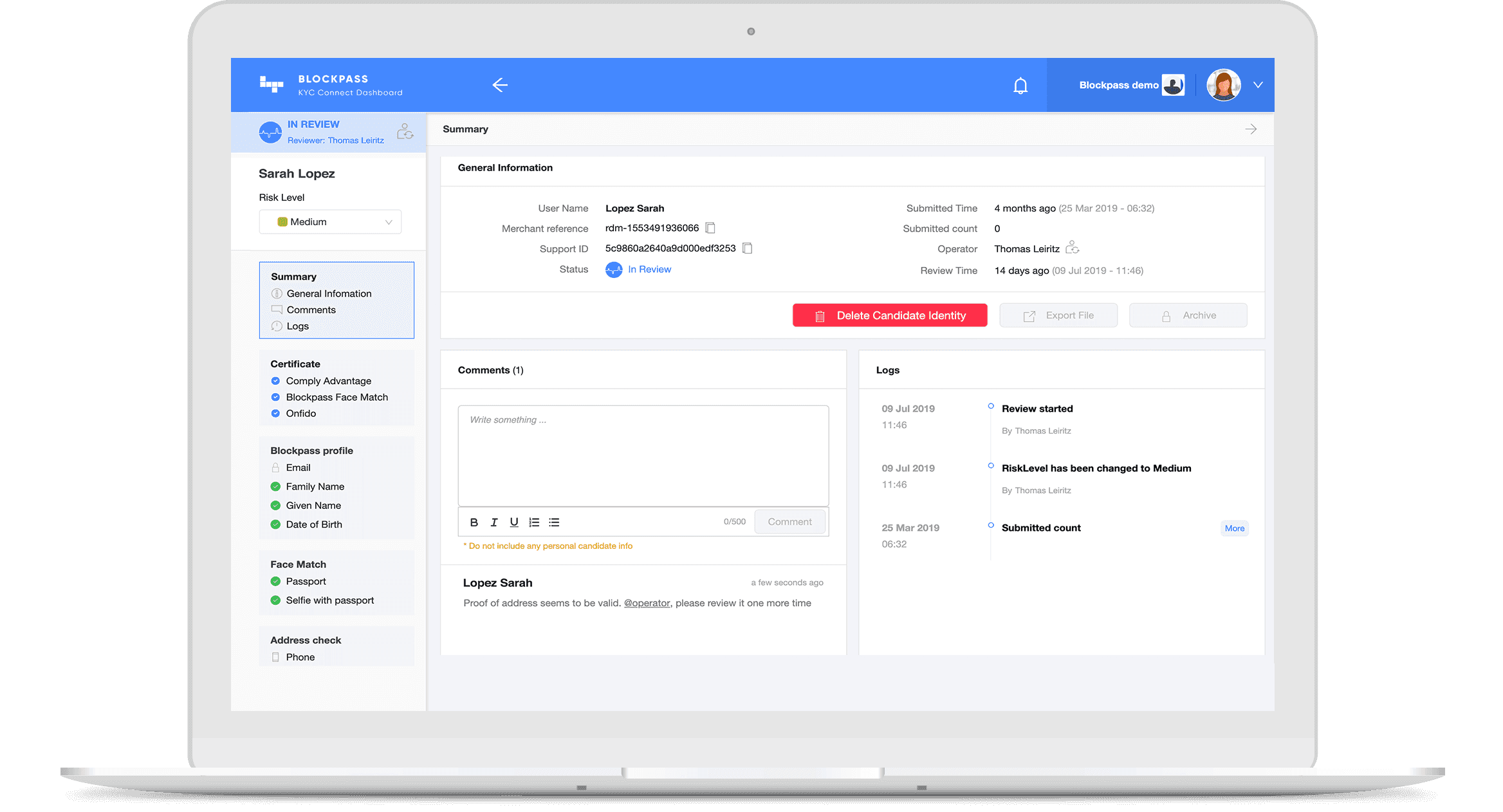

It may be daunting for companies to have to consider when and where to apply Enhanced Due Diligence checks, and an inconvenience having to monitor the status of certain jurisdictions as they pass or fail the regulatory improvement process (for instance, in the past few years Botswana and Mauritius were taken off the Increased Monitoring list whereas Iran moved to the black list). Likewise, the requirements and process of Enhanced Due Diligence may not be familiar to those new to this space. Fortunately, Blockpass is already set up and prepared to cover all regulatory needs, monitoring data and statuses and able to take care of any requirements needed.

The Blockpass platform is fully automated and hosted in the cloud, with no integration or setup fee. Businesses can sign up to the KYC Connect® console in a matter of minutes, test out the service, and start conducting identity documents verification, KYC and AML checks. Learn more below or sign up NOW for FREE at console.blockpass.org.