Blog

MiCA Development Strengthens Crypto Position in EU

October 15, 2022

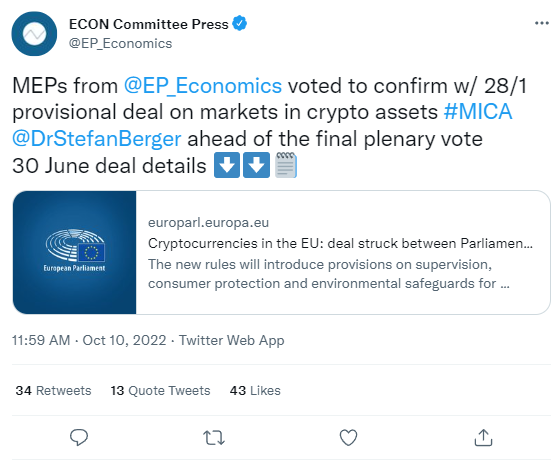

In another move towards the safety and security of regulation, a committee of the European Parliament has voted, almost unanimously, to pass the crypto framework policy ‘Markets in Crypto Assets’ regulation, otherwise known as ‘MiCA’. Members of the European Parliament Committee on Economic and Monetary Affairs (ECON) voted with 28 for and 1 against adopting the proposal. The proposal will go before the European Parliament soon for a final plenary vote, with the position of crypto and its prospects for increased adoption strengthened if the measure passes.

The goal of MiCA is to see the formation of a uniform legal framework for crypto-assets within the jurisdiction of the EU. Beyond protecting people against bad actors through anti-money laundering procedures and terrorist funding countermeasures, the policy also calls out ‘significant’ crypto-assets service providers (CASPs) with the intent of requiring them to disclose their energy consumption. On the other hand, in the current iteration of the proposal, some NFTs (notably those offered to consumers at a fixed price) will be outside the scope of the regulations, although the documentation states there is the potential to reclassify them should their development require.

Given the direction of this policy and the influence of the EU, alongside the general increase in regulatory measures globally, it’s likely that these regulatory standards (or ones not too dissimilar in nature) could be adopted by other jurisdictions around the world. The trend towards ensuring a safe and secure environment through legislation continues in many different ways and now governments are starting to turn to blockchain as a means to stop tax avoidance, finally beginning to leverage the power that an immutable, transparent network brings to fight fraud. This was highlighted recently when the EU recently stated its intention to use blockchain technology to combat tax evasion (another instance where there was an overwhelming show of support for the notion, with 566 for and only 7 against). The proposal also includes the intention of better implementing crypto asset taxation.

The result of this increase in regulation is that crypto businesses are going to need more comprehensive and more suitable solutions for their needs or face increasingly harsh penalties from regulators. Foreseeing this future, Blockpass has been working to solve these sorts of issues for the past five years and already has the means to provide fast, effective and the most cost-efficient routes to comply with both existing and upcoming legislation. With a forward-looking approach the Blockpass team continually review measures that might be necessary to the intersection of blockchain and finance in the future and develop solutions so businesses can be prepared and manage the changes to the regulatory environment with minimal disruption.

The Blockpass platform is fully automated and hosted in the cloud, with no integration or setup fee. Businesses can sign up to the KYC Connect console in a matter of minutes, test out the service, and start conducting identity documents verification, KYC and AML checks. Sign up for FREE at console.blockpass.org.