KNOW YOUR CUSTOMER

The ultimate turnkey digital identification solution for remote and regulated businesses.

Effortlessly streamline your KYC and AML onboarding procedures with ease. Take advantage of the market's most cost-effective and innovative compliance solution, which is designed to lower onboarding expenses and time, automate remediation, boost conversion rates, and eradicate malicious actors, fraudulent activities, and bots.

Why choose Blockpass KYC Connect®?

Stops fraud

Advanced identity checks designed to block bad actors before they enter your ecosystem.

Affordable pricing

KYC solutions priced to fit your budget while maintaining strong compliance and trust.

Start instantly

Get up and running in minutes with ready-made flows and reusable identities.

Crypto-native compliance

Tailored KYC solutions built specifically for the unique needs of the crypto industry.

No integration needed

Access Blockpass KYC instantly without complex integration and without technical setup

No setup cost

Skip upfront fees and long contracts—scale usage up or down as your platform grows.

Ultimate turnkey identification SaaS

Blockpass's software service platform offers extensive, bank-grade KYC/AML features that include an intuitive console for configuration and team management, service dashboards for reviewing applicants, self-service tools and much more.

The checks performed by Blockpass include identity document verification, facematching, liveness detection, proof of address verification, as well as a full range of anti-money laundering screening.

Our KYC specification includes

Document forensic analysis at point of scanning

Tampering detection

Consistency checks of application information and document data

Government template comparison and MRZ validation

Non-live ID image detection for ID documents

Liveness and facial similarity test

Sanctions screening

Adverse media checks

Politically Exposed Persons (PEP) checks

Built by Crypto-Natives & Compliance Veterans

Blockpass was founded and built by a team with significant experience in both the crypto and compliance sectors. Our software suite includes crypto-specific compliance tools that meet current and emerging regulations for businesses handling digital assets or crypto tokens. These tools include On-Chain KYC® - our zero knowledge verification service, Unhosted Wallet KYC™ - our crypto address analysis solution, and VASP2VASP portal - a travel protocol for virtual asset service providers (VASPs).

Versatile features set

Unmatched user support

Blockpass transforms KYC/AML onboarding experience with flexible tiers and powerful automations, ensuring a smooth journey for you and your customers, whether individuals and businesses. Choose your ideal support level from self-service to managed service levels with quicker response time and efficiency.

Dedicated operators

Customers have the option to choose Blockpass dedicated operators, who provide a dedicated support desk for their service(s), manage the customer dashboard, offer additional manual KYC support and review, and provide a dedicated support email address. Our dedicated operators receive accredited compliance industry training.

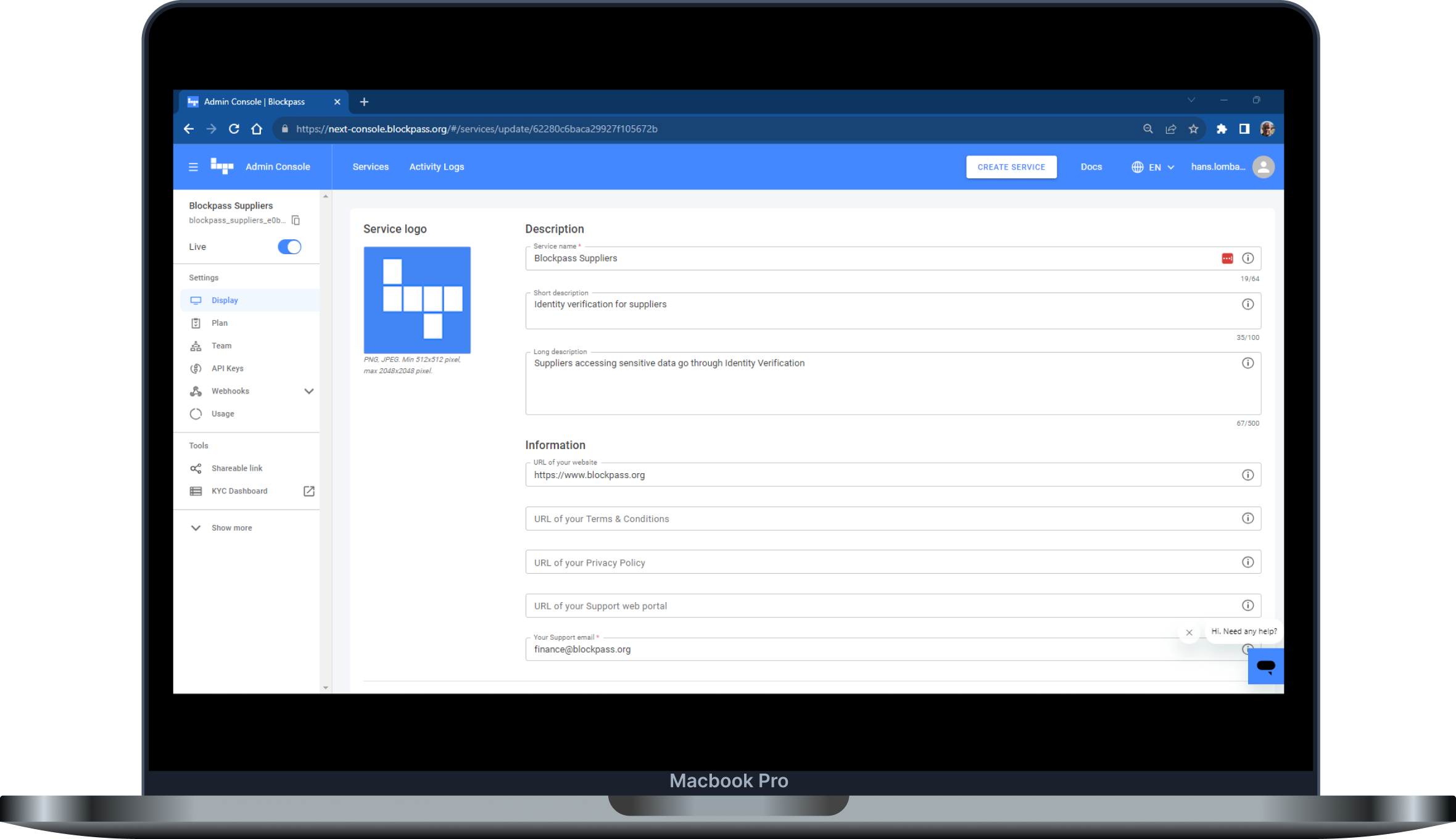

Intuitive admin consoles

The KYC Connect® console provides an intuitive interface for managing your KYC/AML onboarding configuration. With its self-service features, you can easily add team members, track user analytics, issue API keys and webhooks, and set up a dashboard for visualizing and managing the KYC/AML process.

Advanced KYC Bot™

Post-submission automation that runs in the KYC dashboard to process red flags raised by the automated compliance processing system. The remediation covers AML, name/nationality/residency/DOB matching, document deficiency, and national block.

Automated proof of address

Our automated address proof feature allows for the comparison of the address on a document with the provided residential address. It also checks the validity of the document's issue date (usually within 3 months) and compares the user's IP location with their residential country.

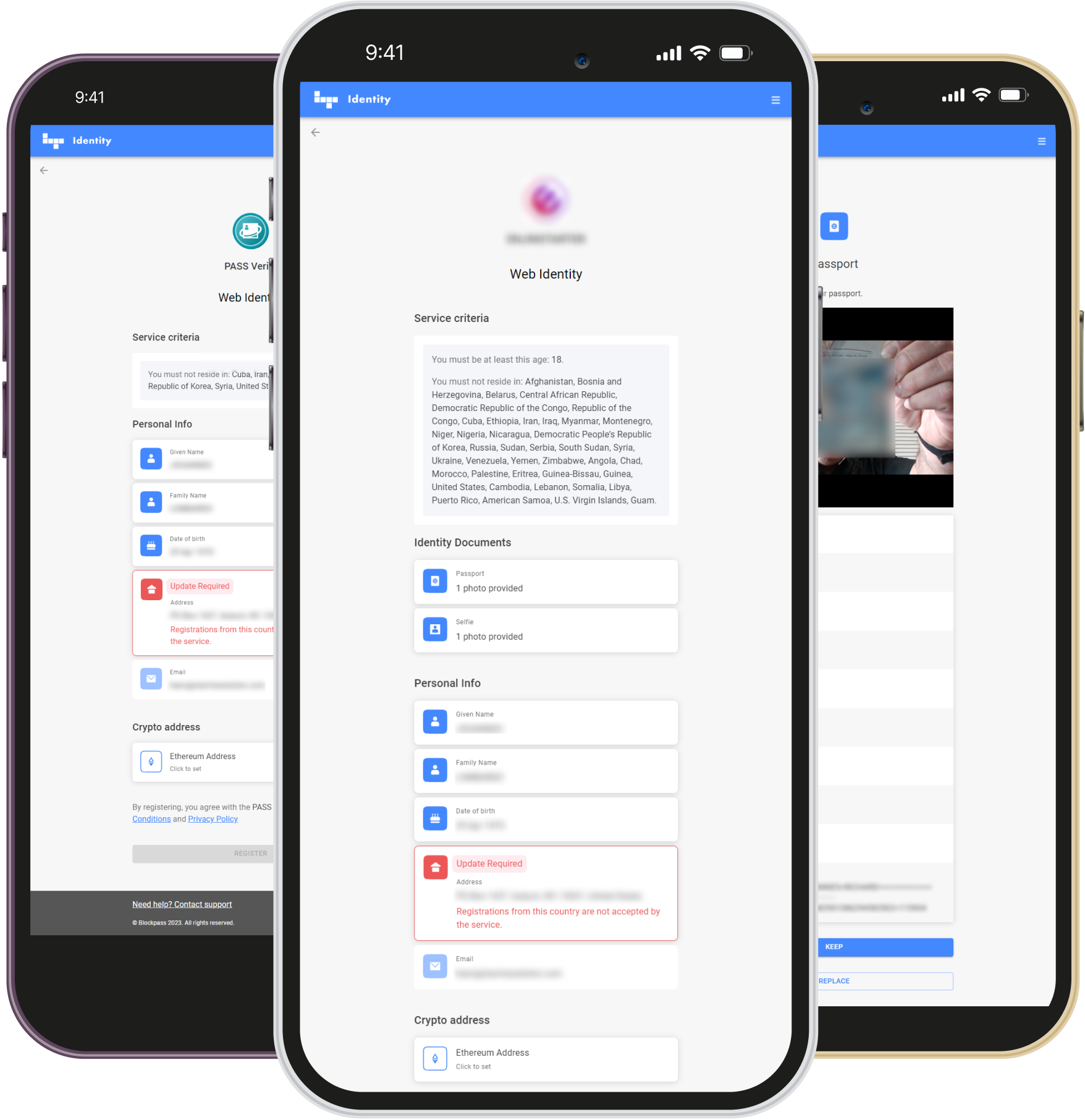

Outstanding user experience

Users who onboard through Blockpass enjoy an exceptional user experience. Their encrypted user profiles are portable and reusable, reducing the stress of having to repeatedly complete KYC. The user-centric and user-friendly secure identity wallet is accessible via web client, Android, and iOS.

Liveness detection

Our liveness technology verifies the humanity of users, proves liveness through a 3D selfie check, mitigates against bots and fraud, and fortifies the security of your onboarding.

Communication system

The platform facilitates direct communication with onboarding users and provides automated messaging for onboarding and document updates. This enables efficient and intuitive user support, quicker resolution of any issues and onboarding.

Enhanced video verification

Blockpass provides enhanced verification of documents through the use of video interviews. These person-to-person live video calls allow for the applicant’s identity and AML to be checked more thoroughly.

A powerful and flexible out-of-the-box tool for onboarding

Seamless onboarding of your customers using Blockpass secure eKYC system. Blockpass users create a pre-verified identity before signing up for your service, meaning that documentation delivery and verification is streamlined. The Blockpass ecosystem has an existing pool of pre-verified users interested in new fintech opportunities and services.