Industry solutions

KYC For Financial Institutions

Know your customer (KYC) is in high demand in the financial industry.

Financial institutions are required by regulatory organizations to conduct KYC procedures across the world before onboarding customers to prevent fraud, money laundering activities and financing of terrorism. KYC helps financial institutions to be compliant and enhance their credibility in the eyes of customers.

KYC and AML for financial services include risk assessments, due diligence and transaction analysis to avoid fraud. There are different levels of Anti-Money Laundering (AML) and anti-fraud measures:

CIP – Client Identification Programs: the basic level of AML that authenticates and verifies client’s identities by the financial institution before onboarding the customer. Simple information to be collected includes: name, phone number, identity documents, proof of address etc.

CDD – Customer Due Diligence: financial institutions are held accountable for whether their customers are compliant with AML standards and need to conduct risk assessments of customers with the provided information. Financial institutions are also required to monitor accounts, detect and report potential financial crimes, on a continuous basis.

EDD – Enhanced Due Diligence: additional level of due diligence for high-risk customers includes ongoing AML monitoring of and countries’ and individuals’ sanctions and Politically Exposed Person (PEP) lists, as well as screening of Adverse Media. The due diligence process should be guided by information provided by AML regulators in the company’s jurisdiction.

KYC Legislative Landscape

KYC law is an increasingly complex issue for the financial industry. Financial institutions have to adhere to both international and local anti-money laundering regulations. Here are some of the policies in place in the EU and USA, two of the top three economies in size.

Europe: The European Union (EU) adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. It indicates financial institutions are obliged to apply customer due diligence during onboarding procedures. It has been constantly revised in order to mitigate risks relating to money laundering and terrorist financing. In 2015, the EU adopted a modernised regulatory framework – the 5th Anti-Money Laundering Directive. More info.

US: The US AML laws and regulations started with the Bank Secrecy Act (BSA) that requires financial institutions to assist the US government to detect, monitor and investigate any potential money laundering activities by identifying suspicious transactions. The USA Patriot Act was passed into law soon after the September 2011 terrorist attacks which amended the BSA and required financial institutions to maintain more formal AML programmes.The Act also prohibited financial institutions from engaging in business with foreign shell banks and increased civil and criminal penalties for money laundering. More info.

FATF: The Financial Action Task Force (FATF) was established to develop policies among the G7 countries to counter global money laundering and terrorist financing. It is an inter-governmental body of 39 economically leading countries that sets international standards adopted by most countries and jurisdictions to fight financing for organized crime, corruption and terrorism. More info.

Blockpass provides financial institutions with an ideal solution for fast and secure KYC and AML compliance, and the ability to flexibly, quickly and easily manage identities. For individuals, Blockpass is a gateway to financial services and other regulated offerings, allowing one click, reusable KYC submission.

Blockpass alleviates the pain of opening new accounts and redoing KYC over and over. Once users create their identity profile the first time and get their identity document rapidly authenticated and KYC and AML checks done, they can instantly onboard to any business or service associated with Blockpass.

Business customers of Blockpass have access to a pool of thousands of pre-verified users in the Blockpass ecosystem who can immediately onboard to those services should the users choose to do so.

Sign up for a Console account to test our service for FREE here.

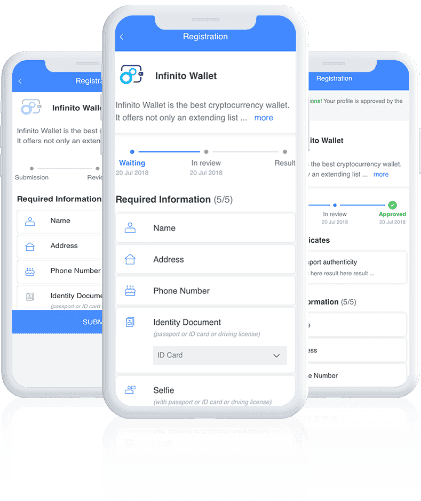

Blockpass provides a compliant solution in the Blockpass Mobile App

A revolutionary app

Blockpass provides identity verification that covers both KYC and AML regulatory compliance. Users fill out the relevant details and are checked against the required lists and criteria to ensure they are not associated with criminal activity.

Instantaneous verification

With the Blockpass technology and approach, verification and onboarding happens almost instantaneously for pre-existing Blockpass users and is usually very rapid for new Blockpass users. In addition, as Blockpass puts users in control of their data and certifications, the solution can be offered at a reduced cost compared to traditional alternatives.

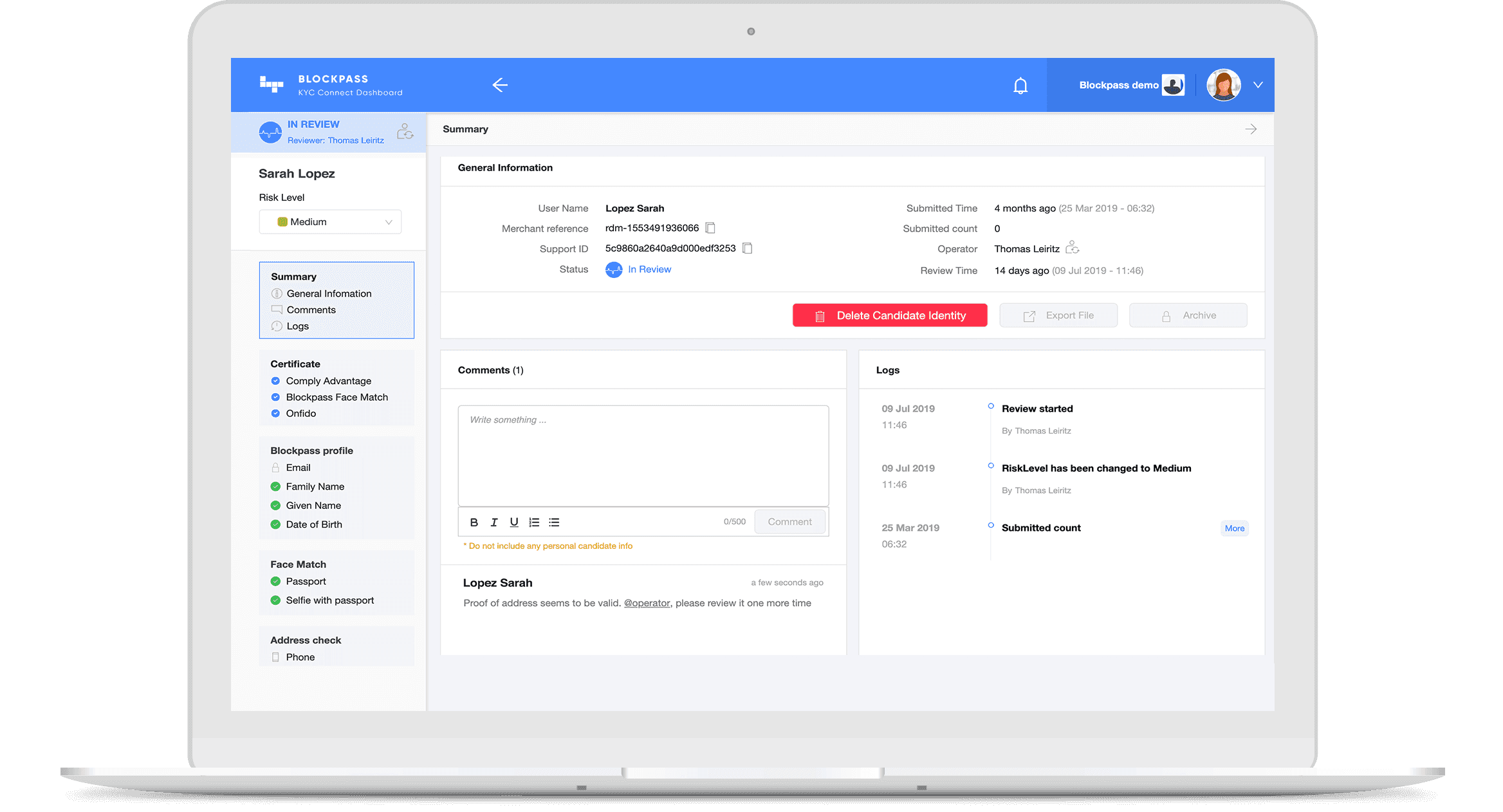

KYC Connect®

A Complete Solution Portfolio

Blockpass offers a multi-product portfolio that allows merchants to choose the scale of solution that applies to each business and jurisdiction. Whether a business wants only Face Match certification, or if they also require KYC, AML or enhanced SLAs, Blockpass is able to offer a full range of identity verification solutions.

NEW Start using KYC Connect®

today through our online docs portal.

Rather than having to fill out the same KYC and AML forms over and over when transacting with other financial companies, users simply have to maintain one up-to-date profile, which is then shareable with anyone in the Blockpass ecosystem for instant onboarding, saving users from repeatedly re-doing and re-submitting the same forms, and saving companies the hassle of checking KYC and waiting on checks.