Industry solutions

KYC For Supply Chain And Shipping

According to the International Chamber of Commerce, Brand Owners, Vessels Operators and Freight Forwarders signed a Declaration of Intent (“DOI”) to combat transportation of counterfeit goods in November 2016.

In the DOI, guidelines have been developed accordingly in various areas to tackle the issue of counterfeit goods within the supply chain including “Best Practices in Know Your Customer (“KYC Best Practices”) for Maritime Operators” initially published in March 2018.

With these guidelines, Maritime Operators, Brand Owners and Suppliers may decide as to whether and with whom they are doing business and who they independently choose to discontinue doing business with, subject to relevant laws.

These guidelines are to ensure Maritime Operators are dealing with legitimate partners who are not involved in illicit trades by verifying, due diligence and ongoing monitors. It consists of 4 steps:

\ Verify identity of customer; verify basic information of the trading partners including the name, registered business address, VAT number and bank account etc. If necessary, further verification by comparing partners’ information with a credible database.

Perform due diligence and ongoing monitoring of their established customers

Identify possible counterfeit shipments, go through a risk assessment of the trading partners including unusual keywords/ suspicious shipping routes

Regular review of documentation and suspected customers

How Blockpass Can Help?

Blockpass is a perfect third party KYC provider to integrate with your project with an industrial grade of KYC and AML compliance. Once users create a Blockpass Identity Profile and upload their identity documents and required data, Blockpass will rapidly verify and authenticate information at the highest standards of regulatory compliance. Blockpass provides ongoing AML monitoring for better risk control, as well as the capability to connect with any database, sanctions or investors list and issue certificates against them.

What’s more, you’ll gain access to the Blockpass ecosystem of pre-verified users, and promotional support to get the most out of Blockpass. Sign up for a Console account to test our service for FREE here!

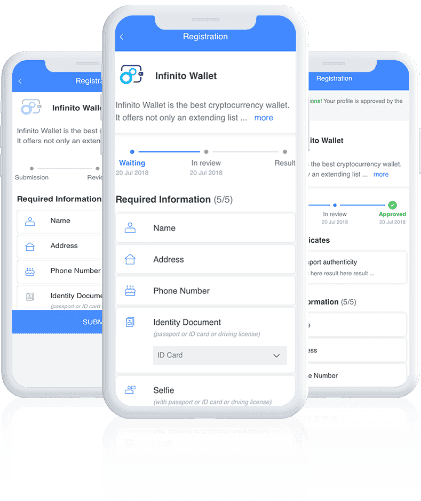

Blockpass provides a compliant solution in the Blockpass Mobile App

A revolutionary app

Blockpass provides identity verification that covers both KYC and AML regulatory compliance. Users fill out the relevant details and are checked against the required lists and criteria to ensure they are not associated with criminal activity.

Instantaneous verification

With the Blockpass technology and approach, verification and onboarding happens almost instantaneously for pre-existing Blockpass users and is usually very rapid for new Blockpass users. In addition, as Blockpass puts users in control of their data and certifications, the solution can be offered at a reduced cost compared to traditional alternatives.

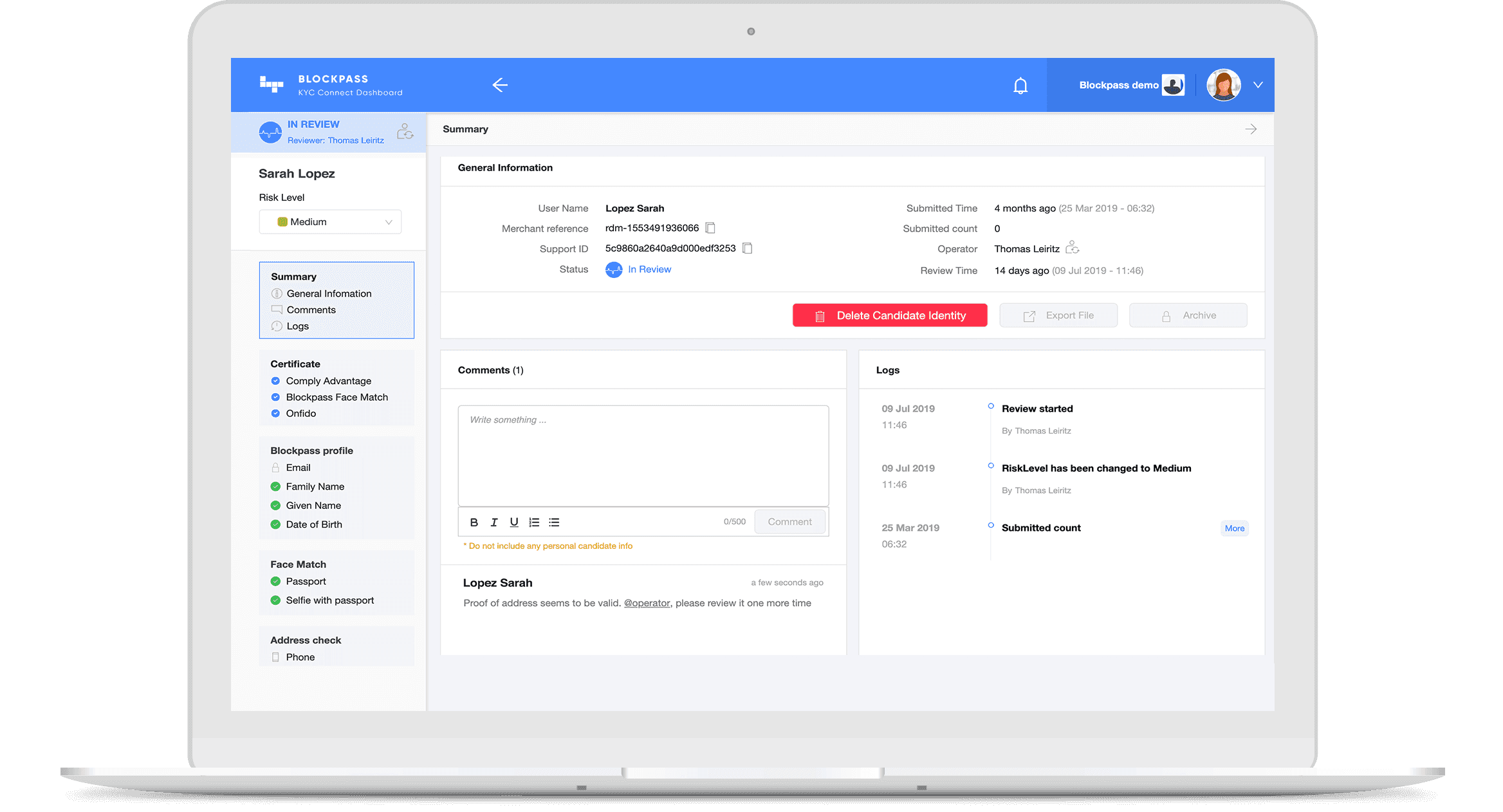

KYC Connect®

A Complete Solution Portfolio

Blockpass offers a multi-product portfolio that allows merchants to choose the scale of solution that applies to each business and jurisdiction. Whether a business wants only Face Match certification, or if they also require KYC, AML or enhanced SLAs, Blockpass is able to offer a full range of identity verification solutions.

NEW Start using KYC Connect®

today through our online docs portal.

Rather than having to fill out the same KYC and AML forms over and over when transacting with other financial companies, users simply have to maintain one up-to-date profile, which is then shareable with anyone in the Blockpass ecosystem for instant onboarding, saving users from repeatedly re-doing and re-submitting the same forms, and saving companies the hassle of checking KYC and waiting on checks.